We are surrounded by digital transactions. Millions and billions of them. These transactions form the foundation of our society. Moreover, the demand for Blockchain-based payment solutions is also increasing. So, we are likely to see much more buzz in 2023.

What is Blockchain Technology?

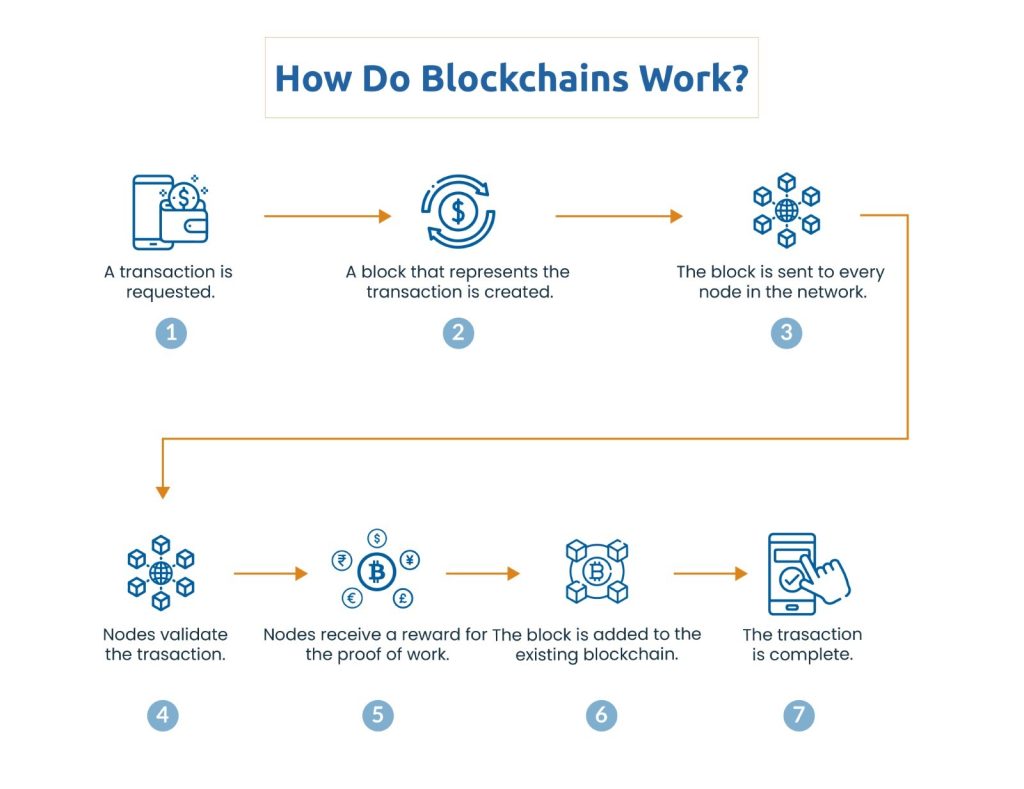

Blockchain is a decentralized encrypted database shared across a network of stakeholders. Where digital transactions can be stored and organized in a transparent, verifiable, and secure way.

Each block added to the chain is time-stamped. This ensures that the information is auditable and traceable at any time. Most importantly, blocks added to a Blockchain can never be removed or modified. Eliminating the risk of data tampering and fraud.

The information added to a Blockchain must be validated by the consensus and accepted by all parties. Rather than by one central administrator. This reduces errors, as there is no single point of control.

In this blog, we will understand Blockchain’s role in secure travel booking payments.

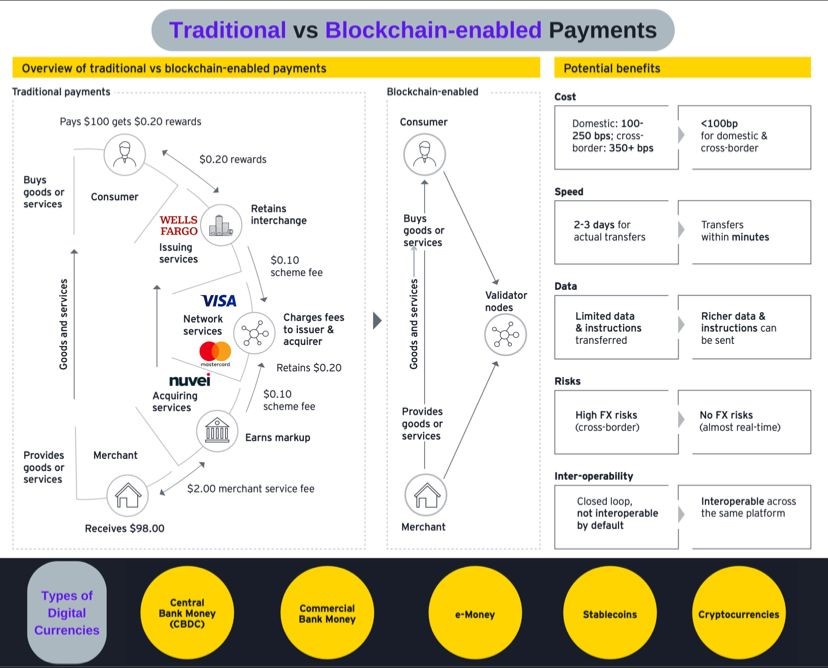

Traditional vs Blockchain-based Payments

Source: Nuvei

Challenges in Travel Booking Payments

- High processing fees

- Increasing cyber-attacks and payment fraud

- Payment settlements

- Delayed cross-border payments

The Blockchain Solution

Is blockchain changing travel business payments? If yes, to what extent it is doing so?

Let’s unfold it.

Easing Payment Settlements Between Travel Operators

Most of the travel companies still send invoices via email. Sometimes there could be disagreements over bookings between an inventory supplier and an OTA business. The supplier may claim some previously agreed term; however, the OTA business might not agree, owing to some circumstances. Saying – I can only pay you for 500 bookings out of 520 on the invoice. In such scenarios, automation using Smart Contracts can be of advantage.

First, let’s understand what a smart contract is. Smart contracts can be thought of as an automated agreement between two or more parties that are written into lines of code. When one party in the contract carries out their side of the agreement, it triggers a specific action on the other side.

Smart contracts make use of blockchain technology to enable trustless, secure, and transparent transactions. This means that smart contracts are automatically enforced by computer code, making them virtually impossible to tamper with once deployed.

Smart contracts are autonomous – free from any central authority. And, once written cannot be changed. You can scrape the entire smart contract, but you cannot make modifications.

Smart contracts can significantly modernize the way OTA operators and service providers operate. In any case, businesses must settle the payments and commission based on the predetermined agreement, that also means – a smart contract. The entire process can be automated, increasing efficiency and saving costs for everyone involved.

Cross-Border payments using Blockchain

Payments are divided into two categories:

- National payments

- International payments

National payments take place within the border of one country. No multi-currency is involved in the transaction. Whereas international payments or cross-border payments occur between two countries with different currencies.

Thus, there is currency exchange. It takes 2-5 working days for the international transaction to clear. The primary reason is the lack of trust between the two banks. Because the US bank would not trust the UK bank and vice versa. Therefore, it’s not easy and as free to transact faster.

Sometimes the connection is established through a series of banks. What happens here is every intermediatory bank through which money transfers charges a processing fee. According to the World Bank, the average transaction costs around 7% of the total transaction. That is the reason international payments are expensive and delayed.

However, there is a simple mechanism to solve this problem. What if we remove all these banks in between. And, allow only the first bank and the last bank to talk to each other in a safe and secure environment?

That’s where Blockchain Technology comes into the picture.

The Blockchain stores data in a tamper-proof manner. The end banks responsible for initiating and receiving the payments can directly talk with each other. Without relying on the banking network and banking channel. It not only reduces the cost but also drastically improves the speed at which money transfers.

For instance, if you book a flight using the Booking.com platform from New York to Mumbai (consider a stopover in Dubai). You will pay the ticket price in USD, while a part of the booking price will then be exchanged into UAE Dirhams and other parts into Indian Rupees. The total price would include embarkation tax, airport security charges, baggage, service charges, and so on. The single booking can involve more than three currency trades if we add car rental and third-party insurance at the checkout.

Secure and Traceable Payments using Blockchain

Blockchain makes payments more secure, particularly when you do not trust a third party to hold your data or act as an intermediary. When something is put into a blockchain, it’s immutable. It cannot be changed, forged, or deleted.

It provides incomparable levels of security by keeping track of every transaction on its network. Through a process called consensus, blockchain ensures that transactions are validated by a network of computers distributed across the globe. As a result, fraud is kept to an absolute minimum.

“The main advantage of blockchain technology is supposed to be that it’s more secure, but new technologies are generally hard for people to trust, and this paradox can’t really be avoided.”

– Vitalik Buterin (Co-founder, Ethereum)

Blockchain-based Payment Initiatives

KrisPay: Rewards Redemption

KrisPay is a digital wallet that allows Singapore Airlines customers to convert their airline KrisFlyer miles into units of payment. It allows you to use your KrisPay miles to pay for items at the airline’s 18 partner merchants in Singapore, including gas stations and beauty product retailers.

Winding Tree: Democratizing Online Bookings

Winding Tree is a private company based in Switzerland that seeks to compete against giants like Expedia and Priceline by using “blockchain technology to enable a fair and competitive travel distribution market. It also allows consumers to make payments in local currency, which is more likely to be spent locally.

The company seeks to connect travelers directly with service providers with their LÍF token. The aim is to minimize fees for travelers while reducing costs for service providers.

Finally

Travel disruptors are actively exploring Blockchain as a tool to reimagine the future of travel and tourism. The use of a Blockchain in the travel industry has the potential to relieve travelers from countless pains, including dealing with local currencies, the lack of transparency, and losing money to exchanges and third parties.

We at Techspian are already investigating the impact it can have on the world of travel. For example, making settlements between different parties like hotels, travel agencies, and aggregators can be a complex process – especially across borders. Blockchain can streamline this process by reducing the intermediaries and the settlement timings. While increasing overall transparency.

The challenge is to find how Blockchain technology can add value. At Techspian, we are uniquely placed to take on this challenge by working together with our partners and customers to embrace the Blockchain.

Know about the Blockchain-based travel platform – Xeni, built in partnership with Techspian.